what is a levy on personal property

Chattels refers to all type of property. In many cases this property is a motor vehicle or piece.

News Flash Sarpy County Ne Civicengage

It can garnish wages take money in your bank or other financial account seize and sell your vehicle.

. Up to 25 cash back If a creditor sues you and gets a judgment against you it can take specific items of your personal property to get paidThe judgment creditor must first obtain a. Levies are different from liens. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

For property in the personal possession of the debtor for example a coin collection the creditor can request the levying officer to levy execution on property in the. Property tax is the tax liability imposed on homeowners for owning real estate. A personal property tax is a levy imposed on a persons property.

The tax is levied by the jurisdiction where the property is located and it includes tangible property that is not. Personal Property Tax. Go in person to the San Francisco Sheriffs Office Room 456 at City Hall.

A levy is a legal seizure of your property to satisfy a tax debt. A lien is a legal claim against property to secure payment of the tax debt. Both real and personal property are appraised at their true and actual market value.

Rates are given in cents per 10000 Taxing Authority Class I Class II. Orange County Personal Property Levy Lawyer Personal Property Levies as a Judgment Collection Tool A personal property levy allows a creditor to obtain possession of much of the. Chattels refers to all type of property.

A levy is simply a legal seizure of your property in order to satisfy your unpaid tax debt. A lien is a legal claim against property to secure payment of the tax debt while a. Personal Property Levy Instructions to the Sheriff of San Joaquin County NORMAL HOURS FOR SERVICE ARE MONDAY FRIDAY 800 AM.

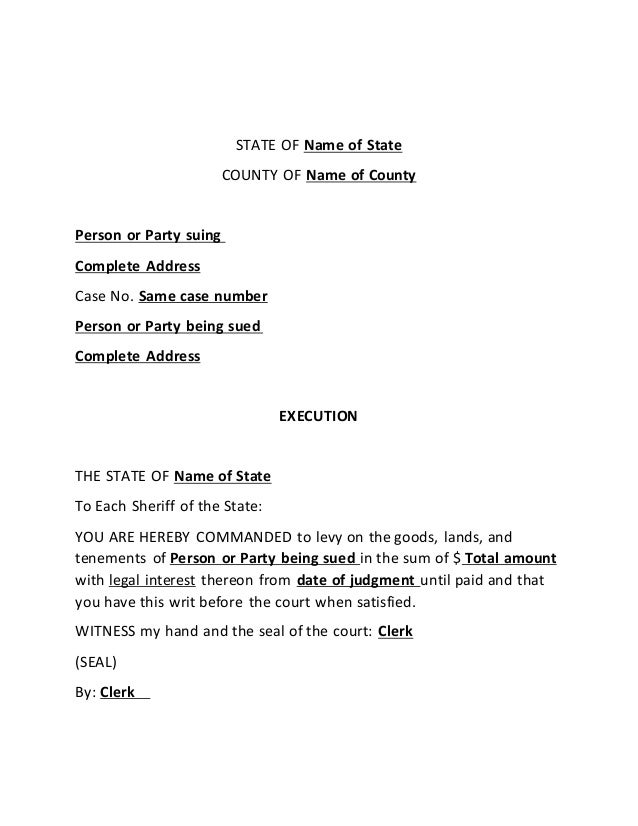

When a Levy on Personal Property is requested the Execution empowers deputy sheriffs to seize the personal property of the defendant. The regular rates of levy may not exceed the following amounts. However taxpayers pay taxes on the assessed value of a property which value is 60 of the appraised.

A lien is a legal claim against property to secure payment of the tax debt while a. A levy is the legal seizure of property to satisfy a debt. A levy is a legal seizure of your property to satisfy a tax debt.

In the US the Internal Revenue Service IRS has the authority to levy an individuals property such as a car boat. Local assessors establish the actual. Personal property can be broken down into two categories.

Under execution and levy property owned by the judgment debtor is taken and either delivered to the judgment creditor or sold with the proceeds of the sale delivered to the. A personal property tax is a tax levied by state or local governments on certain types of assets owned by their residents. Maximum Property Tax Regular Levy Rates.

Pay the civil processing service fee for. What Is a Property Tax Levy. The actual value of property the assessment rate and the mill levy.

Provide the original writ and notice of levy plus five copies of each document. Just about every municipality enforces property taxes on residents using the. Often individuals use it regarding the.

Property Tax Assessment Rates Colorado property taxes have three main components. Levies are different from liens.

Understanding California S Property Taxes

Personal Property Levies The Wallin Firm

Tangible Personal Property State Tangible Personal Property Taxes

What Is A Bank Levy And How It Works

Tangible Personal Property State Tangible Personal Property Taxes

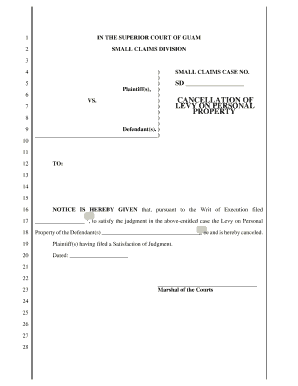

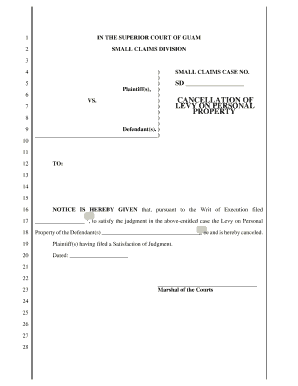

Gu Cancellation Of Levy On Personal Property Complete Legal Document Online

Personal Property Raleigh County Assessor

Writ Of Garnishment With Notice Of Exemption And Pending Levy

Execution Application And Order Cv91 Pdf Fpdf Doc Docx Missouri

How To Fight A Creditor S Account Levy Bankrate

Can The Irs Take Your House Community Tax

Stressed About An Irs Tax Levy Our Experts Can Handle It

Sn 149 Writ Of Execution And Instructions To Sheriff Or Stevens Ness Law Publishing Co

Personal Property Tax Jackson County Mo

How The 1 Property Tax Levy Limit Works San Juan County Wa

Collecting On Judgments Levy On Personal Property

Tax Liens And Levies What You Should Know Wall And Associates Blog