r&d tax credit calculation uk

Discover your potential tax saving through RD activities. Across all sectors the average amount reclaimed for our clients is 50000.

Theatre Tax Relief Example Calculation Examples

Calculate how much RD tax relief your business could claim back.

. 76000 Qualifying Expenditure Calculation. RD Tax Credit Calculator - Direct RD Claim Estimate. Calculate the RD tax credit saving.

Select either an SME or Large. Subscribe to our newsletter. Average calculated RD claim is 56000.

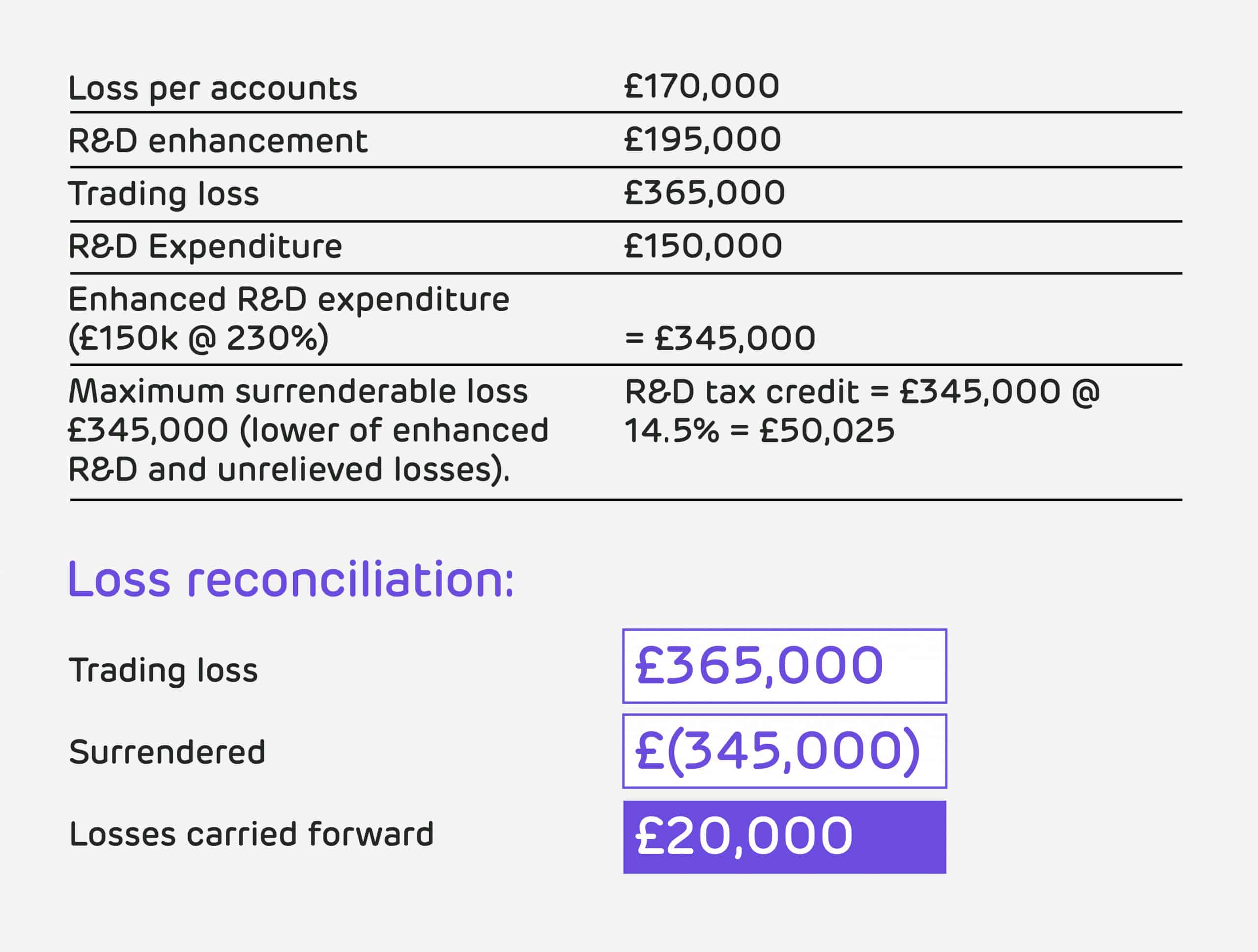

Deduct the RD enhanced expenditure within the tax computation. SME RD relief allows companies to. Loss Making SME Calculation Large Companies RDEC Profitable and.

12350 Is your business Profit Making or Loss Making. Any benefits youre claiming or have just stopped claiming. What Innovation Grants Are.

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. 31 August 2022. The qualifying expenditure is 3000000 thats already in accounts as expenditure Corporation Tax CT before RD tax credit claim is 1900000.

The benefit you will. Youll need details of. If the company spent 100000 on RD projects in a year then its potential RD Credit would be 33350.

This can be done for the current financial year and the 2 previous. Rd report for Based on the information you provided it looks like we could help you claim back up to for. 50000 Start Claim Book a.

The notional additional 130 RD tax deduction is deducted within the company tax computation. Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal 100 deduction to make a total 230 deduction. Corporation Tax prior to RD Tax Credits Claim.

Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. Get to know how much RD spend your company can claim back. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

Just follow the simple steps below. Call 0115 824 0402 Blog RD Tax Credits RD Tax Credit Calculation Examples RD Tax Credits 8 MINS read 19th Nov 2020 RD Tax Relief Online Quiz Eligible companies get. If you qualify you can file an RD Tax Credits claim each year.

The average weekly amount you. HMRC have provided us with the following update regarding delays in the processing of Research Development Tax Credit RDTC relief payments. First however the fix-based percentage must be obtained by.

Free RD Tax Calculator. 100000 X 130 Enhanced rate 130000 Revised Profit. RD Tax Credit Calculator.

RD Tax Credit Calculator. How much have you spent on RD. The RD tax credit scheme is a UK government scheme that rewards innovation in the private sector.

R D Tax Credits Calculation Examples G2 Innovation

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

R D Tax Credits Calculation Examples G2 Innovation

How To Be Proactive With R D Tax Credits Accountants Guide

Sjcomeup Com R D Uk Tax Calculator

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

Return On Investment Roi Formula And Calculator Excel Template

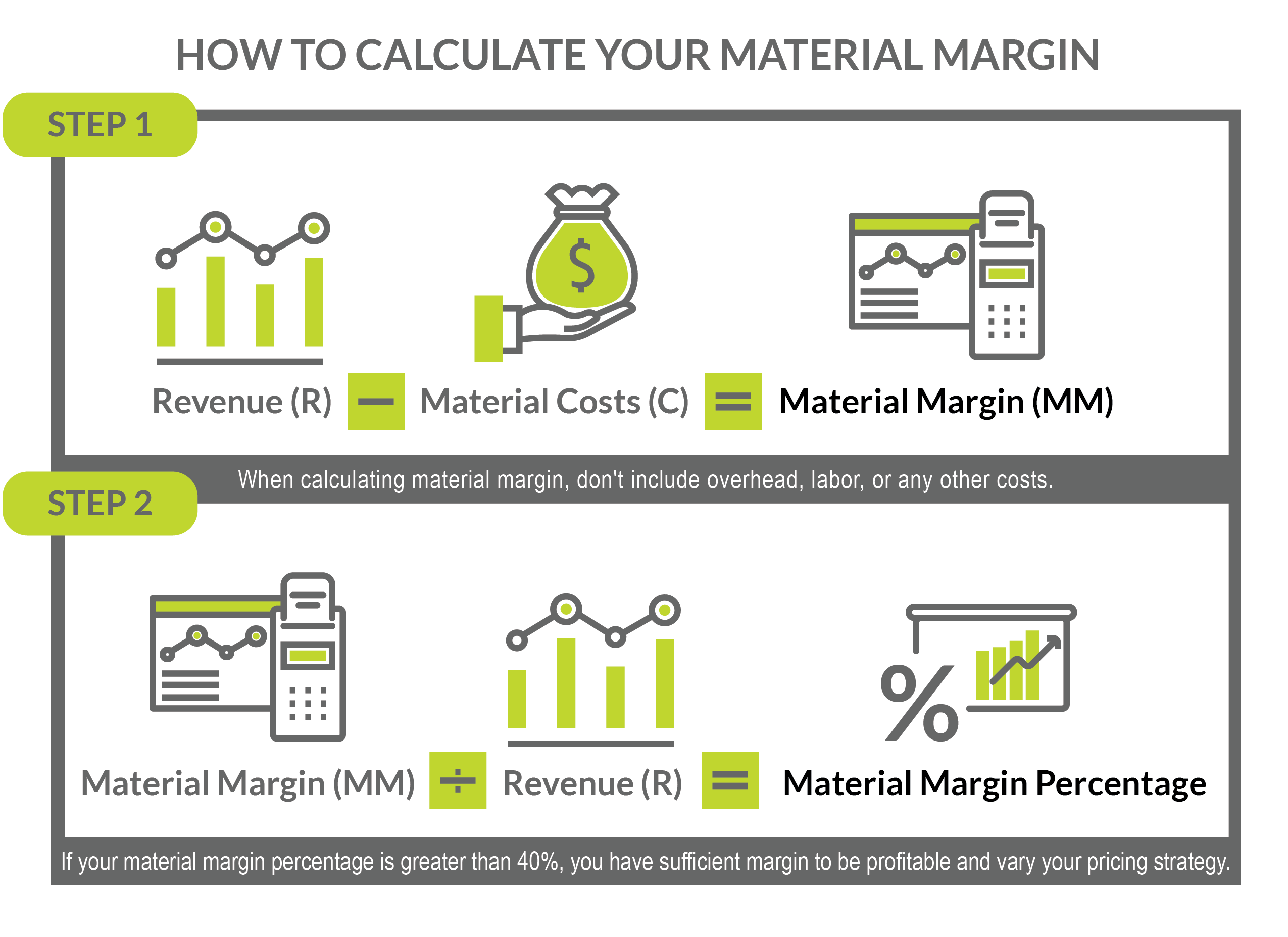

How To Calculate Material Margin And Drive Competitive Pricing

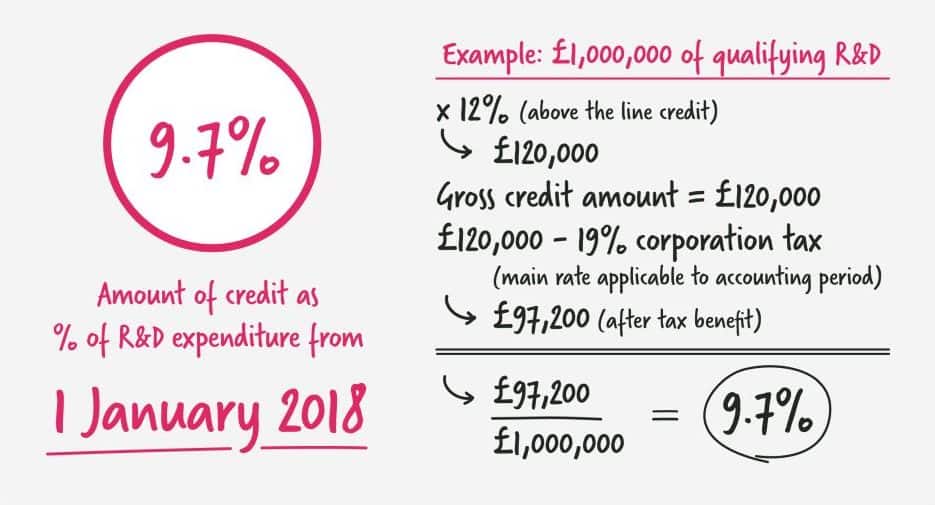

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Credit Rates For Sme Scheme Forrestbrown

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Credits The Rsm Way Youtube

How Is R D Tax Relief Calculated Guides Gateley

Rdec 7 Steps R D Tax Solutions

Taxable Income What Is Taxable Income Tax Foundation

Sjcomeup Com R D Uk Tax Calculator

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credits Calculator Free To Use No Sign Up Counting King