open end credit is quizlet

To better understand open-end credit it helps to know what closed-end credit means. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as much of that money and repay any amount utilized below the set limit within a specified period.

Credit Basics Flashcards Quizlet

Open-end credit is a line of credit that can be borrowed again and again as long as payments are completed on time and in accordance with the banks requirements.

. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed. Generally it is uneconomical and expensive for a borrower to borrow money repeatedly every two or three months and repay it fully. To understand it better a line of credit as used in the definition is a pre-approved amount of.

An agreement or contract lists the repayment terms such as the number of payments the payment amount and how much the credit will cost. 1601 opens new window et seq and its implementing regulation Regulation Z 12 CFR 1026 opens new window were initially designed to protect consumers primarily through disclosuresOver time however TILA and Regulation Z have been expanded to impose a wide variety of requirements and restrictions on consumer. Regulation Z is structured accordingly.

A loan of a certain amount of money that a borrower must repay in a specified number of equal monthly payments. The difference between closed-end credit and open credit is mainly in the terms of the debt and the debt repayment. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due.

Although creditors are not required to use a certain paper size in disclosing the 102660 or 10266 b 1 and 2 disclosures samples G-10 B G-10 C G-17 B G-17 C and G-17 D are designed to be printed on an 812 14 inch sheet of paper. One example of open end credit is credit cards. Example problem for how much you can borrow using a Home Equity Loan.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. Psych 13 14 15. Subtract Balance due on Mortgage in this example 75000 is left 112500 - 75000 37500.

The Truth in Lending Act TILA 15 USC. Open-end credit works borrower is permitted to take loans on a continuous basis and is billed for partial payments periodically Based on difference between current market value of home and amount owed on mortgage. Extended line of credit established in advance.

Open-end credit and Closed-end credit. Start studying credit quizlet. With a closed-end loan you borrow a specific amount of money for a.

150000 x 075 112500. Subpart AProvides general information that applies to both open-end and closed-end credit transactions including definitions explanations. Study sets textbooks questions.

Jane Forresters open-end credit account finance charge was less than 10 at the end of the current billing cycle so her periodic statement need not include disclosures with detailed information on account activity. For example if a customer fails to repay an auto loan the bank may seize the vehicle as compensation for the default. Ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages.

What is open end credit. Open end credit is when a borrower can spend up to a certain amount. Whats another name for.

Closed end credit is a loan for a stated amount that must be repaid in full by a certain date. Closed end credit is a loan for a stated amount that must be repaid in full by a certain date. Whats another name for close end credit.

An example of closed end credit is a car loan. Open-end credit A last resort legal process in which some or all of the assets of a debtor are distributed among creditors because the debtor is unable to pay hisher debts bankruptcy. Businesses hired by lenders to pursue payments on debts that borrowers have not paid back according to the terms of the credit contract.

Payments are usually of equal amounts. A creditor may use a smaller sheet of paper such as 812 11 inch sheet of paper. Mortgage loans and automobile loans are examples of closed-end credit.

Fees and interest rates charged by the lender are the costs of these sorts of credit. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by. Learn vocabulary terms and more with flashcards games and other study tools.

Closed end credit has a set payment amount every month. Advantages of Open Credit. Closed end credit has a set payment amount every month.

What are examples of closed-end credit. Common types of closed-end credit instruments include mortgages and car loans. Approximate market value of your home.

Lets assume a lender will loan 75 of your homes current market value. Which of the following is an example of open end credit quizlet. What is the difference between open end credit and closed end credit quizlet.

Understanding Different Types Of Credit Check Sort Each Scenario Into The Correct Category Based On Brainly Com

Managing Credit Vocabulary Flashcards Quizlet

Get Quizlet Digital Flash Cards For Mobile Studying Flashcards Vocabulary Flash Cards Learning Tools

Personal Financial Literacy Chapter 11 Flashcards Quizlet

Credit Basics Vocabulary Flashcards Quizlet

Alternate Credit Flashcards Quizlet

Credit Basics Vocabulary Words Flashcards Quizlet

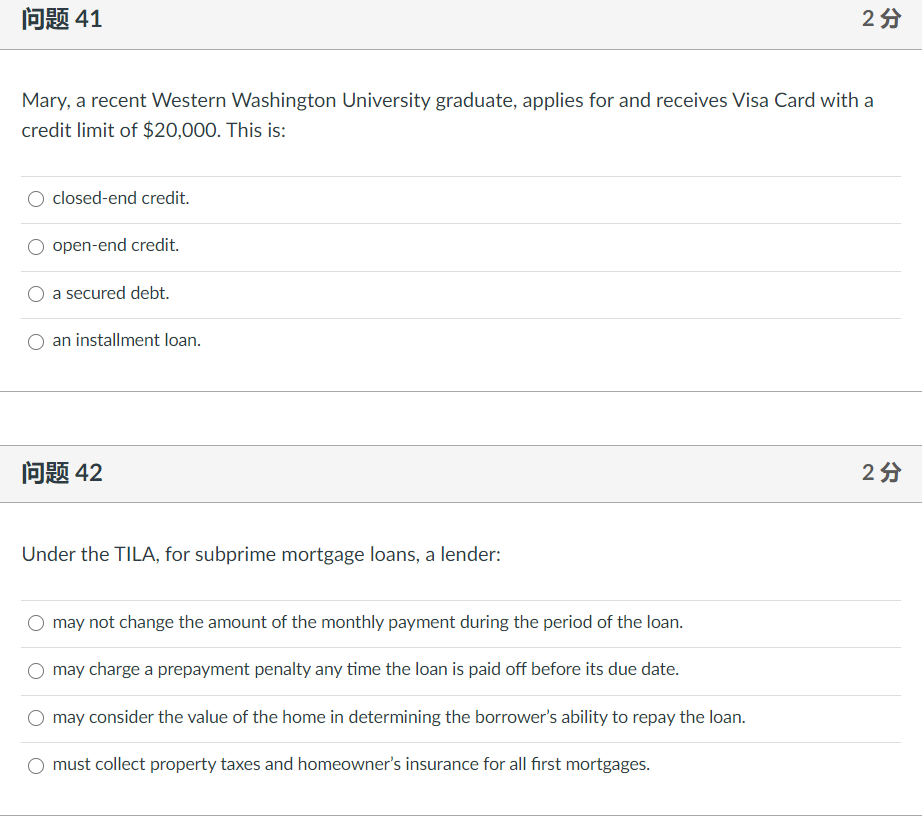

Solved 问题41 25 Mary A Recent Western Washington University Chegg Com

Credit Basics Vocabulary Flashcards Quizlet

Revolving Credit Vs Line Of Credit What S The Difference

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference

Bc Credit Cards Review Diagram Quizlet

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

:max_bytes(150000):strip_icc()/GettyImages-140194262-0b646f7aae144213af52c5ee27cf841d.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)